The next few articles will cover the basics of what is debt, where it came from and whether it is so bad. Hopefully as seen in the cover photo, the idea of debt can seem more manageable and less worrisome after these readings.

If we could time travel and take money from our future selves for the present day, then we would not need debt, almost. But because we can’t, we need some other way to bring consumption forward. We can then borrow from our future selves but at a cost.

Debt in normal terms arises because we need or want something now, but don’t have the money to pay for it. Instead of waiting, we agree to sacrifice paying more but in smaller increments over time. The cost of this luxury is interest.

Let me use an example to explain why the cost of this luxury matters. As of the end of October last year (2021) the prime lending rate in South Africa was 7% p.a. it is now at 9.75% p.a. That is almost a 40% increase in the cost of borrowing money. Unless your income increased by the same amount in the last year, you are sitting with a problem and an even bigger one the more debt you have. Practically, if you bought a R1 Million house last year, you paid R7,700 per month on repayments. Now, it would cost R9,500. This is an extra R 1,800 that most people won’t have lying around.

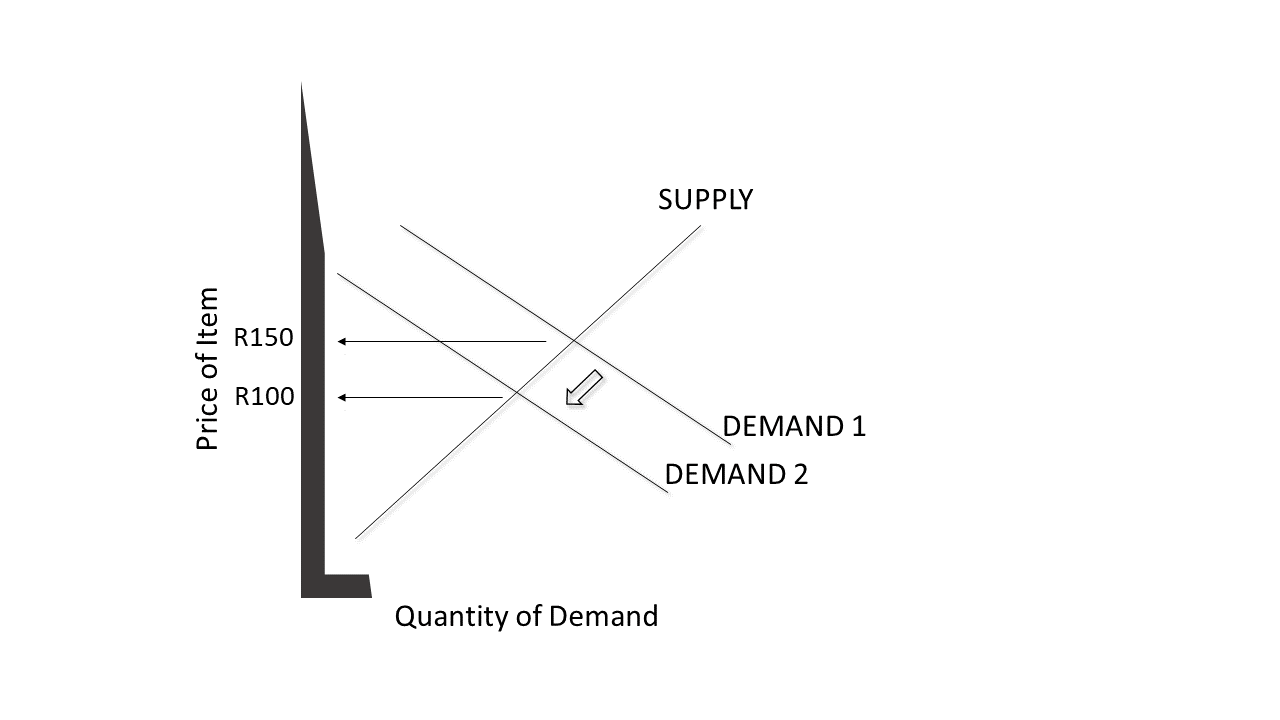

The reason the cost of debt increases or decreases, is to heat up or slow down this consumption. If it costs more to borrow, I will probably borrow less. This means the demand for goods and services, in general, will decrease, and the price of goods and services will also decrease or at least stop increasing. This is the climate we are currently in due to the high inflation globally.

Your credit history, which is influenced by variables like your level of debt and how promptly you pay your debt off, is the most important consideration in how much interest you would be charged on any loans. Any score over 600 is pretty good and will probably result in lower loan rates.

Click here

https://www.transunion.co.za

Now that the basics have been explained, we will look into the benefits or pitfalls of debt in future articles.