“Your greatest asset is your earning ability. Your greatest resource is your time.” – Brian Tracy

What is money in the bank?

Words are often used interchangeably, like saving or investing when describing putting your money away for future consumption. However, there is a difference and each has specific use cases.

When one says that they are saving it is usually in a prime savings account or similar bank account which earns a bit of interest while the money sits there. You can access it whenever and it always grows with interest. Investing, on the other hand, is deliberately putting your money or allocating capital to something that you hope will return more than you put in, as payment for you giving up that capital.

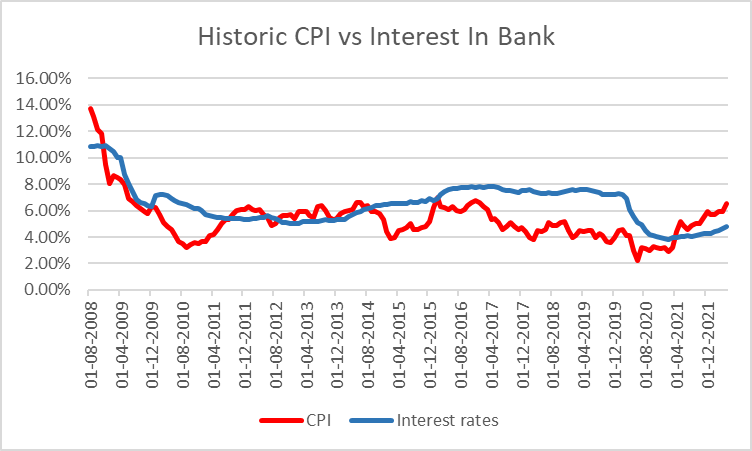

Historic South African inflation vs Bank interest rates

The following graph shows how interest rates are lagging to the inflation, which means as prices go up, only a couple of months later will your interest slowly increase to match. It also indicates that at best, the money you leave in the bank that you are "saving" is not growing in real terms. In reality, it is most likely not keeping up with inflation and you are actually eroding away at the real value you are saving🤣

Is It Ever A Good Idea?

Use cases for saving into a bank account are definitely there. For example, if you need to pay for a holiday at the end of the year and you know how much it will cost. Your means of paying for it could be saving Rx each month and earning interest in the meantime. However, if you are saving for a holiday in 3 years time this would not be the best idea and a stable unit trust investment is the better option.

Unit trusts that have the objective of preserving capital like a stable fund can earn a return of just above inflation while not being too volatile so you can sleep well at night. (If risk is not your thing)

Note: this is not financial advice, but something you can chat to your financial advisor about to find something suitable for your situation.